Fiscal Myths

The anxiety about the fiscal health of the United States and the insane dismantling of the federal workforce is cloaked in intentional misinformation. There are real challenges to be addressed, but we accept false framing and refuse to speak honestly about them.

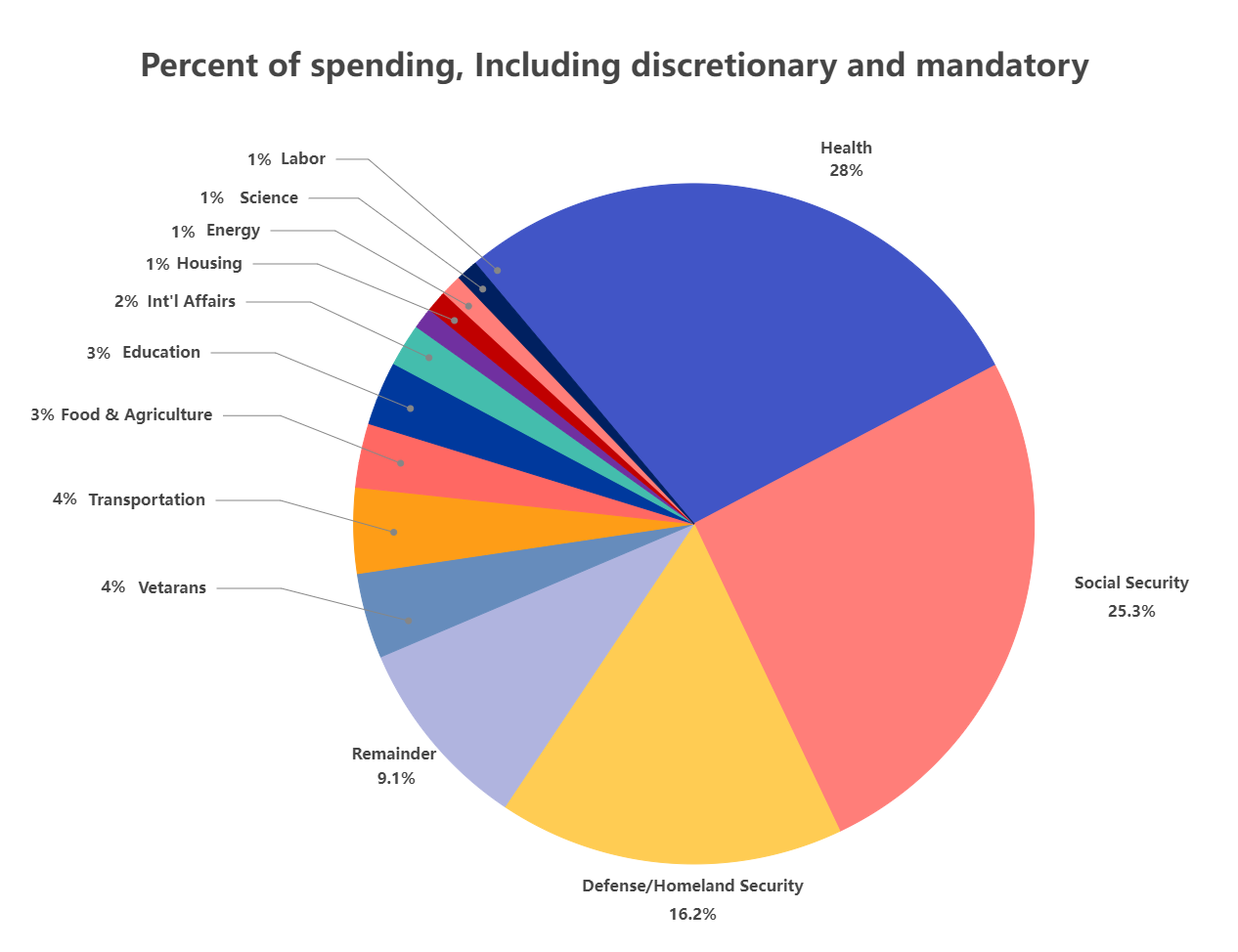

A cursory glance at a pie chart of federal outlays for the latest fiscal year will demonstrate that it is highly redistributive, not from rich to poor but from young to old. Spending on Social Security and healthcare (primarily Medicare) comprises more than half of federal spending. Where does this money come from? It comes from the current taxes paid by younger, working Americans. It does not come from the money seniors “paid into” the system. That is a myth. It is a giant lie that prevents any serious solutions to the problem.

You may have heard that the Social Security and Medicare “Trust Funds” are predicted to run out of money in 2035 or 2036. Sorry, but there are no trust funds. It is an accounting fiction. All money collected by the federal government from payroll taxes, income taxes, excise taxes, and tariffs goes into the same pot and is spent the minute it is collected. Social Security has run a cash deficit since 2010. In 2024, this deficit was $169 billion. Over the next ten years, it will be over $3 trillion if no changes are made. All of that money must come from current taxes or government borrowing. There is no trust fund to draw upon.

When Social Security was running surpluses prior to 2010, that extra money was spent in the years it was collected. That means older Americans benefited from lower taxes and higher government spending than would have otherwise been possible during those years. The money was not put into a savings account, and it certainly wasn’t “invested” for future payouts. Now, those same people (soon to be me) are benefiting again from these “entitlements” at the expense of more borrowing or higher taxes on younger working Americans. It is no wonder that people over the age of 55 own 73% of all wealth in the country. We are redistributing wealth from the poor to the rich, not the other way around.

We love to say we care about our children and grandchildren, but our behavior does not align with that sentiment. Until we are honest about the true nature of Social Security and Medicare, we will never address the fiscal problems facing the United States. Compensation for civilian federal employees represented 4.3% of the budget in 2024. Cutting all of them is not going to balance the budget. The math is the math, and lying about how entitlement programs are funded prevents progress and hurts America.